On March 28, CIMC Group (000039.SZ/02039.HK), a world leading supplier of logistics and energy equipment, announced its audited results for the year ended December 31, 2022 (FY2022 ).

1. FY2022 Key Highlights

Total revenue was RMB141.5 billion, maintaining above RMB 100 billion level. Net profit attributable to shareholders and other equity holders of the Company after deducting non-recurring profit or loss was RMB 4.28 billion, the second highest performance in history

— Total revenue was RMB141.5 billion, a decrease of 13.54% YoY; The share of domestic income rose steadily to 51.5 percent.

— The gross profit was RMB21.6 billion and the gross profit margin was 15.28%.

— The operating profit was RMB7.505 billion, a decrease of 44.29% YoY.

— Net profit attributable to shareholders and other equity holders of the Company was RMB3.219 billion , a decrease of 51.70% YoY; Net profit attributable to shareholders and other equity holders of the Company after deducting non-recurring profit or loss was RMB4.28 billion , the second highest level in history.

— The consolidated asset-liability ratio decreased from 63% to 57%, mainly due to disposal of CIMC Financial Leasing and absorption of minority shareholders’ funds by subsidiaries.

— The final dividend of 2022 is planned to be RMB 1.8 (tax included) per 10 shares, and the dividend payout ratio is maintained at 30%.

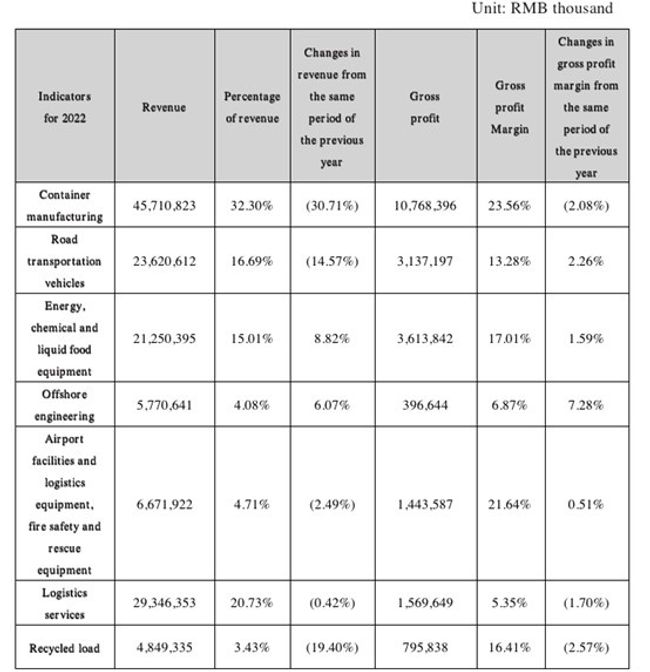

7 Major segments financial results

— Container manufacturing: Revenue was RMB45.71 billion, a decrease of 30.71% year-on-year, accounting for 32.3% of revenue. Gross profit was RMB10.77 billion, with a gross profit margin of 23.56%, a decrease of 2.08% year-on-year.

— Road transportation vehicles: Revenue was RMB23.62 billion, a decrease of 14.57% year-on-year, accounting for 16.69% of revenue. Gross profit was RMB3.1billion, with a gross profit margin of 13.28%, a increase of 2.26% year-on-year.

— Energy, chemical and liquid food equipment: Revenue was RMB21.25 billion, an increase of 8.82% year-on-year, accounting for 15.01% of revenue. Gross profit was RMB3.6 billion, with a gross profit margin of 17.01%, an increase of 1.59% year-on-year.

— Offshore engineering: Revenue was RMB5.77 billion, an increase of 6.07% year-over-year, accounting for 4.08% of revenue. Gross profit was RMB0.4 billion, with a gross profit margin of 6.87%, an increase of 7.28% year-on-year.

— Airport facilities and logistics equipment, fire safety and rescue equipment: Revenue was RMB6.7 billion, a decrease of 2.49% year-on-year, accounting for 4.71% of revenue. Gross profit was RMB1.4 billion, with a gross profit margin of 21.64%, an increase of 0.51% year-on-year.

— Logistics services: Revenue was RMB29.35 billion, a decrease of 0.42% year-on-year, accounting for 20.73% of revenue. Gross profit was RMB1.6 billion, with a gross profit margin of 5.35%, a decrease of 1.70% year-on-year.

— Recycled load: Revenue was RMB4.85 billion, a decrease of 19.40% year-on-year, accounting for 3.43% of revenue. Gross profit was RMB0.8 billion, with a gross profit margin of 16.41%, a decrease of 2.57% year-on-year.

2. 2022 Business Review

1) Consolidate the core advantages of the manufacturing industry and lead the green, intelligent and digital transformation of the industry

— The container manufacturing segment has entered the period of “star-driven” strategy. While the sales volume of the star and satellite business has consolidated the first place in the world, the manufacturing process has continued to lead the green upgrade of the container industry through the “digital workshop” and “future factory”.

— The road transportation vehicles business maintains the first place in global semi-trailer sales and the top ranking in the domestic special-purpose vehicle market. At the same time, based on the advantages of transoceanic operation, the overseas market performance of the road vehicle business is strong, and the sales of semi-trailers of multiple categories rank top in North America and Europe market.

— The energy, chemical and liquid food business has achieved steady growth in the three main tracks of “energy equipment, chemical equipment, and liquid food equipment”, and the core business has maintained its leading advantages at home and abroad

— The strategic transformation of the offshore engineering business has achieved remarkable results. Seizing the opportunities in the dual prosperity track of offshore oil and gas equipment and clean energy, the dollar amount of newly signed orders and orders in hand increased by 77% and 122% respectively year-on-year

— The airport facilities and logistics equipment business further consolidated its leading edge in airport equipment, and officially delivered Asia’s first driverless boarding bridge for use, promoting the intelligent revolution of China’s airports.

Specifically, In the revolution of green energy replacing fossil energy, CIMC Group are always full of ambitions in the field of new energy, and prepared for changes in technological routes. CIMC Group have made an all-round layout for key equipment such as hydrogen energy, offshore photovoltaics, offshore wind power, and energy storage.

— In terms of hydrogen energy, the market share of CIMC hydrogen energy “storage, transportation and processing” equipment has increased significantly. During the period, CIMC have also strengthened the upstream “hydrogen production” capacity, and reserved coke oven gas hydrogen production and electrolyzer hydrogen production equipment technology. In 2022, CIMC Group has deployed the entire industrial chain advantages to show great development potential for the Beijing Winter Olympics and the hydrogen industry to provide solutions for electrolyzed water hydrogen production, hydrogen energy storage and transportation solutions, and pressure regulation hydrogen supply system solutions.

— In terms of offshore photovoltaic and offshore wind power, CIMC have arranged high-end equipment such as offshore wind power installation ships and booster stations in an orderly manner, and actively received orders in domestic and overseas markets.

— In the maintenance business, breakthroughs were made for major customers in various businesses such as wind turbines and underwater anti-corrosion testing.

— In terms of energy storage, CIMC group have complete long-term and short-term technical routes, and the battery energy storage business has delivered energy storage integrated systems to industry leaders in batches.

2) Seeking progress in a stable manner and continuously expanding the growth point of service revenue.

— The Group’s service revenue exceeds RMB 30 billion, accounting for about 21% of the total revenue.

— The logistics service segment is a major starting point for CIMC to transform the service industry. Relying on the advantages of “equipment + technology”, it will penetrate the value chain of the logistics and transportation industry vertically and horizontally

— It expands asset operation business on general equipment such as road transportation vehicles and cycle carriers.

— The after-market service of special equipment products enhances customer stickiness with professional, digital and intelligent services and expands revenue sources.

3) Maintain product leadership, lead in technological innovation, and constantly emerge specialized and special innovations

— We have increased our investment in R&D, with an annual investment of RMB 2.520 billion, up 12.48% year-on-year and accounting for 1.78% of our revenue, which is higher than last year.

— The Group has 9 national “small giant” enterprises and 6 national manufacturing single champion enterprises (products).

— This year, four of the Group’s patents won the 23rd China Patent Award, the highest number of awarded patent projects in the past years.

4) ESG is integrated into operations to implement business for good.

— Awarded AA rating by Wind, ranking first in the machinery industry and among the top 10 A-shares; tied for second place in the “Top 100 Chinese Enterprises in Sustainability 2022” and selected for the fourth consecutive year; selected again as a constituent stock of the Hang Seng A-share Sustainability Enterprise Benchmark Index.

— In July 2022, CIMC Charity Fund was established to contribute to the education of our country, and the number of recipients is expected to cover nearly 2,000 people in 2025.

— Promote the management of greenhouse gas emissions and actively respond to climate change. in 2022, the Group’s carbon emission intensity (tons of CO2 equivalent/billion yuan of revenue) will be reduced by 16% compared with the previous year.

3. Strategic Progress and Outlook for 2023

The Group will continue to enhance and integrate its advantages in “logistics, energy equipment manufacturing + services”, and focus on consolidating its position as an industry leader, so as to promote the consolidation and improvement of the Group’s overall performance in the future. On the one hand, the Group will continue to consolidate its main business of equipment manufacturing, integrate upstream and downstream industrial chain resources, provide more comprehensive and integrated services, and accelerate the promotion of green, digital, and intelligent transformation and upgrading of products, so as to build up its leadership in products through technological innovation. On the other hand, we will adhere to the national development strategy as the guide and seize the historical opportunities in the “smart logistics” and “clean energy” sectors to broaden the connotation scope of the existing advantageous main business, and will also focus on the four strategic themes of “cold chain”, “clean energy”, “clean water and lush mountains” and “rural revitalization” to build core competitiveness in emerging businesses.

(1) In the Logistics Field:

Container Manufacturing Business

It is expected that the supply and demand in the container shipping market may maintain a slight balance in 2023, and the demand of containers, compared to the previous level, will also return to normal. In light of the large volume of over-aged old containers to be phased out and replaced, the replacement demand will provide continuous support for the market. In long term, the recovery of global trade will be promising, and the core segment of demand in the container market is expected to show a stable-to-rising trend. Container Manufacturing Business will optimise connotation, improve its comprehensive competitiveness and consolidate its leading position in the industry through continuous investment as well as management improvements in technology and equipment, such as the Dragon Project.

Road Transportation Vehicles Business

In 2023, with the demand for logistics and transportation in China gradually recovering, that for semi-trailers was also undergoing a rebound, which, in combination with the tightening implementation of the new national standards for semi-trailers, will certainly lead to an acceleration of the upgrading and iteration of semi-trailers in China. With the increase in demand for retail consumption of the North American residents, that for road transportation and semi-trailer equipment in North America is expected to remain buoyant. Since the introduction of the National VI emission standards, the impact of such a switch in emission standards on the special purpose vehicle industry has gradually diminished, which is expected to meet with a resurgence, with the penetration rate of new energy special purpose vehicles gradually increasing. With the ending of the transition period of the new regulations on the blue-plate light trucks, the trend of the light truck industry’s compliant development is getting increasingly obvious, with new energy light trucks entering a fast lane of development.

Airport Facilities and Logistics Equipment, Fire Safety and Rescue Equipment Business

In respect of the airport facilities and logistics equipment business: On the one hand, smart airport will continue to be a global trend, and intelligence will accelerate the electric upgrading and updating of obsolete equipment in the airports; meanwhile, as the continuing and rapid development of the air transportation industry as well as the increasing air cargo logistics projects, logistics equipment system provider will carry out comprehensive competition in terms of timeliness, reliability and mass production; on the other hand, in 2023, the domestic and overseas aviation logistics is expected to continue to recover, the number of air passengers and cargo transportation will increase significantly, and it is expected that a large number of delayed procurement needs in the early stage will also be made.

In respect of the safety and rescue equipment business: Upon the establishment of the Ministry of Emergency Management, the fire rescue work converts from “single disaster” into “comprehensive rescue”, accompanied by higher demand for fire safety and rescue equipment as well as the increasing market needs in relevant industry. To respond the big-data construction of “smart fire safety” across China, the active development of intelligent, modular, unmanned and high-performance firefighting and rescue equipment, the enrichment of emergency products and technologies, the promotion of application of new technologies and new energies in the fire safety and rescue industry are trends of the development of the industry for a long time in the future.

Logistics Services Business

The Group will enhance the domestic and foreign cargo collection capacity for its Logistics Services Business, continually provide reliable, professional, flexible, customized, integrated and end-to-end logistics service plans for its customers through 1) focusing on the key sector of multimodal transport, expanding the global landscape, strengthening the deployment of local service capacity in international ports of destination, and increase joint venture cooperation with railways, connecting the multimodal transport including “river, sea, land, railway, air” by domestic and international hub nodes, to enhance its cargo control capability at home and abroad; exploring and building green transportation resources, comprehensively enhancing its capability in serving the entire chain, and accelerating its layout in specialized logistics service fields such as fresh and cold chain logistics, clean energy logistics and special cargo logistics; 2) in terms of logistics technology, increasing investment in R&D, building a digital visualization platform, enhancing standardized operation, exploring the application and operation platform of intelligent equipment, comprehensively enhancing its technological capability, and facilitating the green, digital intelligence and high-quality development of multimodal transport, to continually provide stable, excellent and smooth logistics service for its customers.

Recycled Load Business

Looking forward to 2023, leveraging on the advantages of enhancing quality and reducing costs, the operation concept of recycled loads will continually permeate in the industrial sectors, and with the recovery of domestic consumption, the market demand for recycled loads will also increase. The new energy industry represented by the sectors of new energy battery and photovoltaic will continue to develop rapidly, and thereby, drive the rapid development of new energy recycled loads business.Apart from strengthening the existing operations, the Group will continue to enhance its business expansion, optimise and improve the operation capacity for the recycled loads business.

(2) In the Energy Industries Field:

Energy, Chemical and Liquid Food Equipment Business

Clean Energy: In the long run, benefiting from the carbon neutrality, the demand for and the proportion in primary energy consumption of natural gas still have more room for improvement. Accompanied by the gradual transformation of supply pattern of global energy, the demand for infrastructure of import and export terminals will continue to increase, and the storage and transportation equipment business may be expanded as a positive result of the increased proportion of natural gas consumption. Especially, as for hydrogen energy, 2023 will be the booming stage of hydrogen energy policies, and will be functioning as the bridge of the implementation of industrial commercialisation, promote the multidimensional and collaborative development of the upstream,midstream and downstream sectors of the industry.

Chemical Environment: Under the background of iterative upgrading of global industry as well as the stringent implementation of the laws and regulations related to safety and environmental protection, the chemical products gradually transformed from a low and primary level into a high-end and high-value-added level, leading to the diversifying demands for the tank containers. China, as the largest chemical production and consumption market in the world, is committed to promoting the professional and safe transportation of chemical products, advocating the construction of professional transportation and loading equipment and supporting facilities of chemical products, which provides more development opportunities for the application of tank containers.

Liquid Food: According to the research report issued by Imarc Group on the global food and beverage processing equipment market, the scale of such market reached US$58.2 billion in 2022, which is expected to achieve a growth rate of 5.3% each year (i.e. the compound annual growth rate (CAGR)) from 2023 to 2028, the global beer market is expected to grow at a CAGR of 3.7%, and the Asia-Pacific region will achieve the highest growth rate. The demand for Whisky and other spirits is also expected to grow rapidly in the future, including the mechanized and intelligent transformation of production lines of white wine under the continuous promotion of relevant industrial policies in China.

Offshore Engineering Business

Looking forward to 2023, in respect of the oil and gas platform business: higher oil prices and the trend of continuous exploration and production of oil and gas in ultra-deep water have made the traditional offshore oil and gas business gradually recover, among which the FPSO business has performed well. It is expected that, benefiting from Petrobras’ oil production increase plan in the medium to long run, the number of orders newly signed in the FPSO market has grown strongly, and the capacity utilization rate of offshore manufacturers will be greatly improved in the next three to five years. In respect of the clean energy business: carbon neutrality brings major development opportunities for the industry. Offshore wind power, hydrogen energy utilization, offshore photovoltaics will form a huge industry scale, which will further consolidate the transformation of global offshore engineering equipment. Offshore wind power installation related equipment and operation and maintenance services will develop rapidly. In respect of the special vessels business: the continual growing sales of new energy vehicles worldwide promotes the expansion of global automobile seaborne trade volume, which, superimposed by factors such as environmental protection, will lead to strong demand for new-build ro-ro ships.