By Gelonghui

As the earnings season approaches, once again listed pharmaceutical companies are attracting the attention of the public. Recently, China Medical System Holdings Limited (CMS or the Company) has released its annual results, with both revenue and profit higher than market expectations. According to its 2020 annual results, turnover is up by 14.4% to RMB6.946 billion; net profit up by 30.7% to RMB2.556 billion; basic earnings per share up to RMB1.024, with a proposed final dividend of RMB0.20 per share.

In the past, influenced by expectations of the effects of China’s centralized procurement policy and the Company’s product transition, CMS’s valuation in the capital market was once under pressure, but with the Company’s strategic transformation from a CSO to an innovative pharmaceutical company, coupled with its own solid business growth, its share price has gained a significant increase in the past few months but is still relatively low in the capital market. The Company’s current dynamic P/E ratio is only about 13x, with a market value of HK$ 39.4 billion. However, market values of innovative pharmaceutical companies without profits such as BeiGene and Junshi Biosciences have well exceeded HK$50 billion or even HK$100 billion in HKEX. This shows that the share price of the Company does not reflect its real value after its transformation. It’s worth digging deeper into the innovative pipeline of the Company to take a look at its long-term growth potential and the inevitability of valuation increase.

1. Firm in transition, the Company is using the S&D model to drive its innovative development

Looking back at its history, the Company began introducing exclusive or original drugs from multinational pharmaceutical companies through rights control or exclusive sales agreement early in 2010, creating a unique “CMS Model”. Under this model, the Company has accumulated a strong network of overseas upstream resources and a good reputation, and formed a strong product evaluation system. However, considering the potential impacts of the Company’s existing products, which are all original or exclusive drugs with expired patents or no patents, and China’s centralized procurement policy on performance growth, CMS began to actively adjust its business strategy and transformed into an innovative pharmaceutical company at full speed since the end of 2017.

The true meaning of rebirth lies in the courage to kill your past self. As a CSO leader, CMS takes advantage of its competencies in the deployment of innovative drugs in its gradual transformation and has formed a development path that is different from most other biotechs and innovative pharmaceutical companies.

First of all, the Company’s original business has maintained steady growth over the years and generated strong cash flow, which has given it the confidence to further expand its business, while its long-term accumulated resources and networks overseas have also given it more opportunities to quickly deploy overseas innovative resources. For various reasons, CMS has transformed itself into a venture investor in overseas pharmaceutical companies and actively promoted its presence in the innovative drug field. Through equity investment in overseas biotech companies and strategic cooperation, the Company has rapidly formed an R&D pipeline covering a number of innovative products in just around three years.

The following are some highlights of the Company’s deployment of innovative drugs:

a) Excellent BD capability and mature system help CMS enter into the innovative drug field quickly

Compared with the R&D (research & development) path, which is common in pharmaceutical companies, the Company adopts an S&D (search & development) model, i.e., gradually enriching its innovative pipeline through global search for quality innovative drug projects and early R&D participation. This model particularly tests the Company’s ability to screen and evaluate products.

Looking back at the Company’s history, as a leading CSO company, CMS’ unique vision and product selection ability has been fully verified by the introduction of a series of blockbuster original products with clear efficacy, sufficient clinical evidence and competitive differentiation in the past. The Company has also achieved excellent performance with these quality products for a long time. And with the transition, this long-tested ability is continuing to help its selection of innovative products.

In fact, as the fastest way to deploy innovative drugs, the Company has also polished a complete and mature BD system. From top-level design, introduction strategy, clinical development in China, to the match with existing products and sales teams, and even product commercialization, CMS has built a thorough mechanism and cultural foundation that are suitable for the growth and commercialization of innovative drugs.

In the past three years, CMS has quickly acquired more than 20 innovative products with unique competitive advantages, including Diazepam Nasal Spray, Tildrakizumab, Cyclosporine Eye Drops 0.09%, etc., and achieved great results, which fully validates its strong and sustainable BD capability and forms a competitive moat, providing CMS with opportunities to achieve a higher premium valuation.

b) Avoiding competition in over popular products, CMS tries to find “diamond in the rough” with a differentiated product selection strategy

In fact, according to its footprint in innovative product deployment, due to its innate promotion-driven genes, the Company is more capable of exploring new products from the perspective of marketing and promotion. It does not blindly pile up popular products but takes cost-effectiveness, market potential and whether meeting unmet market needs as the benchmarks, and takes a long-term view of the commercial prospects and the localization value of the innovative pipeline.

In recent years, there have been pharmaceutical companies who spend a lot of money to buy some seemingly sexy, but very competitive drugs. Taking PD-1 for example, its R&D costs hundreds of millions of dollars, but the competition between pharmaceutical companies is fierce. With the price reduction caused by national centralized procurement, it is clear there has been serious involution in this field. This is the kind of field that CMS has been intentionally avoiding in its selection process. The innovative drugs that the Company has acquired all have differentiated competitive edges and considerable market potential. Taking the products mentioned above as examples, Diazepam Nasal Spray is an innovative drug targeting acute repetitive seizures that is convenient to use outside the medical setting with a very rapid onset of action; Tildrakizumab is a novel monoclonal antibody targeting IL-23 with high cost-effectiveness for the treatment of psoriasis; Cyclosporine Eye Drops 0.09% is a novel, preservative-free, clear ophthalmic solution using a globally patented nanotechnology for the treatment of dry eye.

In addition, let’s take the Methotrexate Pre-filled Syringe/Pen introduced by the Company last year as an example to see the characteristics of its deployment of innovative drugs. Methotrexate is an API with a long history and is referred to in many articles as one of the ten landmark drugs in human history, while many biological agents under development now are also clinically compared with methotrexate injections for equivalence. But even so, as an inexpensive and efficacious old drug, there are severe gastrointestinal side effects in oral preparations resulting in decreased patient compliance, and there are currently neither pre-filled methotrexate injection products approved, nor methotrexate injectables for the treatment of RA on the Chinese market. It is based on this typical unmet clinical need that the Company chose to introduce this drug to fill the market gap.

c) Rapid clinical advancement capability with significant organizational and institutional strengths

Although CMS does not have a CMO with a strong background for the time being, its medical team and clinical capabilities should not be underestimated. In terms of clinical works, CMS plays its resource advantages in clinical development by strictly controlling the core clinical processes such as clinical protocol formulation, patient enrollment and quality control, and cooperates with CROs to jointly promote clinical projects in China.

Most of CMS’s innovative drugs are in late clinical stages or already marketed in the U.S. or Europe. So, in the design of clinical trials in China, the Company’s medical team needs to refer to the clinical protocols of its overseas partners, and then make adjustments and innovations to make the protocols suitable for the Chinese market. Currently, all of the registration trials are progressing smoothly. In addition, with its 3,000+ professional promotion staff and a wide range of hospital and physician resources, CMS has the solid strength needed to quickly enroll clinical patients and promote the clinical development of products. For example, on March 11, the Company announced that it had completed enrollment of all 220 subjects required in the registration bridging trial of its blockbuster innovative drug Tildrakizumab in China in just 2.5 months.

d) Strong academic promotion capability helps commercialization of innovative drugs

With more than two decades of successful experience in academic promotion, the Company has accumulated extensive industrial and network resources to carry out the commercialization of innovative products in the future. Its well-established system has also been providing great support to the commercialization of innovative products whether in terms of compliance management, digitalization, or team management and training.

The Company has repeatedly mentioned in financial reports its efforts in refining management and compliant marketing, such as optimizing organizational structure, strengthening the application of digital tools, enhancing compliance training, etc. Meanwhile, the Company has made continuous efforts on digital promotion for many years, thanks to which, its selling expense ratio has remained at around 22% for years, which is at a relatively low level in the industry. In addition, the Company has a professional team and organizational system. By the end of 2020, the Company’s academic promotion system has covered about 57,000 hospitals and medical institutions nationwide, with 3,300 professional academic promotion staff. As a company noted for sales and promotion ability, its strong professional academic promotion capability and compliant and efficient system will bring broad market prospects for its innovative products once commercialized.

2. Great market potential for the innovative pipeline and great room for growth for the Company

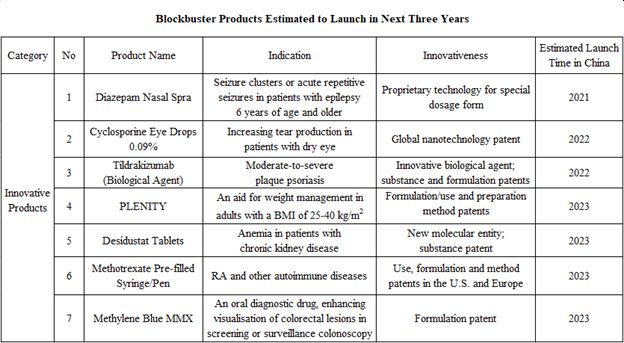

According to the Company’s financial report, by the end of 2020, the Company has more than 20 innovative products with relatively high innovation level, high market potential, and competitive differentiation advantages, among which, 9 products have been approved for marketing in the U.S. and/or Europe, and 3 products are in the registration clinical trials in China.

According to the R&D progress of its products, the Company is expected to have a number of blockbuster products marketed in succession, which may provide new growth points for the Company.

Next, let’s take a look at some of the blockbuster products that are expected to be marketed soon as well as their market potential:

a) Diazepam Nasal Spray

The product is indicated for acute repetitive seizures in patients six years of age and older, and is expected to be marketed this year. It has received marketing approval from the U.S. FDA, and the Company has completed dosing and blood sample collection of all subjects in the registration trial in China in 2020, and is expected to submit an NDA in the near future.

According to Chinese epidemiological data, it is estimated that there are approximately 6 million active epilepsy patients in China, with an additional 400,000 new patients each year. According to the 2002 WHO Demonstration Project, only 37% of Chinese patients with active epilepsy received medication with a treatment gap of 63%, which means only about 2 million patients with active epilepsy received regular treatment. Of the 2 million patients, 20-30% are out of effective control, with an average of nearly 70 recurrent seizures per year. Therefore, it can be estimated that the product’s target patient population is at least 400,000, assuming an average of 30 seizures per person per year, and a selling price of RMB300 per spray (with reference to the selling price of about US$300 per spray in the U.S.), the market potential of the product will exceed RMB3 billion per year.

b) Cyclosporine Eye Drops 0.09%

Expected to be launched next year, Cyclosporine Eye Drops 0.09% is used to increase tear production in patients with dry eyes and has a global nanotechnology patent. The Company received the clinical trial notice of the product from NMPA of China in June 2020 and completed the first subject dosing in December, expecting the product to be launched in 2022.

Data shows that the incidence of dry eye in China is about 21-30%, while epidemiological data shows that patients with moderate-to-severe dry eye account for about 40% of dry eye patients. According to this projection, there are over 100 million patients with moderate-to-severe dry eye in China. Since there are various channels of treatment for eye diseases in China, assuming a 10% hospital visit rate for patients with moderate-to-severe dry eye, the target treatment population would be about 10 million. In terms of treatment cost, the clinical study of Cyclosporine Eye Drops 0.09% shows significant improvement in the primary endpoint after 12 weeks of treatment with 2 doses of the product per day, so assuming a 12-week treatment course of the product and a treatment cost of RMB25 per dose (with reference to the selling price of about RMB25 per dose of Zirun(R) 0.05% Cyclosporine Eye Drops (II) of Sinqi Ophthalmic Medications), the product would cost about RMB4,000 per treatment course. Combined with the target population of about 10 million projected above, the market potential for this drug will exceed RMB3 billion if the Company could cover 8% of the patients.

c) Tildrakizumab

Tildrakizumab is used for the treatment of moderate-to-severe plaque psoriasis, and has already been approved for marketing in the U.S., Europe, Australia, and Japan. In China, with the completion of all subject enrollment in the registration clinical trial, the product is expected to be marketed in 2022.

Chinese epidemiological data shows that the incidence of psoriasis in China is about 0.47%, with a total number of patients exceeding 6.5 million. Among them, about 30%, or 2 million patients, are with moderate-to-severe psoriasis. Regarding the current market size of monoclonal antibodies for psoriasis in China, according to the prices of monoclonal antibodies already approved, which generally cost tens of thousands to hundreds of thousands in RMB for annual treatment, and taking into account the price reduction in NRDL price negotiations, RMB100,000 can be taken as the average annual treatment cost. Assuming that the penetration rate of biologics in patients with moderate-to-severe psoriasis can reach about 20% in the future, the entire market size of monoclonal antibodies for psoriasis will exceed RMB40 billion. With the Company’s strong sales and promotion ability, assuming that the product takes 12% of the market share in the future, the peak sales could reach about RMB5 billion.

d) Others

By 2023, the Company’s products such as Plenity (an innovative weight loss product), Desidustat (indicated for CKD anemia), Methotrexate Pre-filled Syringe/Pen (pre-filled injectables indicated for RA), and Methylene Blue MMX (enhancing lesion detection during colonoscopy) are expected to be approved for marketing, all of which also have a market potential of at least RMB1 billion.

Taking Methotrexate Pre-filled Syringe/Pen as an example, it is easy to use, convenient for self-administration at home and strikes a greater balance of efficacy and safety, excellent tolerability, and compliance. With 5 million RA patients in China, the peak sales of this product is estimated to exceed RMB1 billion. Methylene Blue MMX is also a product with promising market potential. It has been clinically proven to improve the detection of all lesions during colonoscopy and is easy to use. If it is included into the routine procedure of full-spectrum colonoscopy in the future, the sales potential of this product is estimated to be at least RMB1 billion as there about 10 million colonoscopy cases in total in China.

3. Conclusion

To conclude, CMS’s advantages in the deployment of innovative products come from two aspects. On the one hand, the Company’s strong BD ability built up in its long-term development gives it the confidence and strength to quickly enter the innovative drug field, and at the same time, it does not blindly chase after popular products but focuses on digging overseas quality innovative products with relatively high market potential and unmet market demand using its differentiated product selection strategy. On the other hand, the resource advantages based on the strong marketing and promotion system empower the Company with rapid clinical advancement ability and strong academic promotion ability, which strongly supports the clinical development and commercialization of innovative products. Based on all these, CMS has made remarkable achievements in its transformation, and it is believed that with the marketing of blockbuster innovative products, the Company’s value will be re-recognized by the market and its valuation will usher in a new leap.

After CMS released its annual results, several institutions have published research reports that are optimistic about the Company’s transformation focusing on innovative drugs and its long-term potential. First Shanghai Financial Group emphasized CMS’s unique vision of product selection, strong profitability of BD projects, and high efficiency in clinical development of blockbuster innovative products. It projected that CMS will have six innovative drugs marketed in China in the next three years, and with the Company’s strong academic promotion ability and the products’ own differentiation advantages, it’s believed that once these products are marketed, they’re expected to bring considerable contribution to the Company’s performance. Industrial Securities mentioned that the Company’s Cyclosporine Eye Drops 0.09% and Tildrakizumab are expected to be approved in 2022 and four other innovative products to be approved in 2023. With the successive launch of these innovative products, the Company’s product mix is expected to be significantly optimized.

In addition, Citi reported that the Company’s management is committed to acquiring licenses for five competitive innovative drugs each year, and the nasal spray for epilepsy is also planned to be launched in China this year, which are expected to continuously contribute to its revenue; meanwhile, the Company has several other drugs that are expected to be launched in China in the next few years, based on which Citi raised its earnings forecast for 2021 and 2022 by 39% and 57%, respectively. At the same time, Citi raised its target price of CMS by 134% to HK$26 from HK$11.1, with a “buy” rating.

In summary, it is not difficult to find that all these institutions have full recognition of CMS in its presence in the innovative drug field. They have all raised their target prices of the Company based upon the Company’s performance and potential. Compared with ordinary investors, professional institutions tend to have a deeper understanding of the industry and the enterprise. These bullish reports have all shown that, despite the fact that the Company’s share price has almost doubled in the year, they still have full confidence in the Company’s future potential.