43% of participants show optimism on outlook for 2022 economy

A highlight event celebrating the 25th anniversary of the Hong Kong Special Administrative Region (HKSAR), the 15th Asian Financial Forum (AFF), organised by the Government of the HKSAR and the Hong Kong Trade Development Council (HKTDC), came to a successful conclusion yesterday (11 January). Running on the theme Navigating the Next Normal towards a Sustainable Future, the online-only AFF 2022 featured real-time polls to gauge the views of participants on a spectrum of topics, including the global economic outlook, environmental, social and governance (ESG), climate risks and green investment trends. This year, over 700 one-on-one matchmaking meetings between investors and project owners have been arranged in the three-day AFF Deal Flow Matchmaking Session. As of 11 January, the AFF virtual platform had seen more than 63,000 views from 80 countries and regions.

Delivering his remarks on the second morning of AFF 2022, Paul Chan, Financial Secretary of the HKSAR, noted the tremendous opportunities for Hong Kong’s financial market created by Mainland China’s continued development. “The national 14th Five-Year Plan sets out the long-range objectives of the country through the year 2035, and strategically affirms the role and positioning of Hong Kong in the overall development of our country, presenting opportunities in various areas of importance. Of all the specific roles for Hong Kong that have been reaffirmed or established, the one of particular relevance to us on this occasion is Hong Kong’s continued expansion as an international financial centre, encompassing the strengthening of our status as a global offshore renminbi business hub as well as an international asset management and risk management business centre,” Mr Chan said.

43% of poll respondents optimistic on global economy; 33% say lack of unified ESG standards as top challenge of businesses

Online polls have been conducted during the AFF to gauge participants’ views on a range of issues including the global economic outlook and ESG. It found that 43% of respondents were optimistic about the outlook for the global economy in 2022 – a significant increase from 32% in the poll at AFF 2021 – while 33% of respondents had a neutral view and 24% expressed pessimism. The results indicate a generally more positive sentiment towards economic prospects in 2022.

When asked about the most significant barrier preventing their companies from implementing more ESG-friendly policies, 33% pointed to the lack of unified, easily understandable ESG standards and 22% cited the difficulty in balancing ESG practices and business goals. As for the sectors with the most opportunities for green investment in Asia, 45% identified green energy, followed by real estate and construction (16%), transportation infrastructure (14%) and agriculture and food (14%).

Pulse survey says neglecting ESG will lose business opportunities and clients

PwC and the HKTDC jointly presented a pulse survey, “ESG Investing: Challenges and Opportunities for Hong Kong”, during AFF 2022. Speaking at the forum, Elton Yeung, Vice Chairman of PwC China, said the survey indicated that more than half of the respondents believed that neglecting ESG factors could affect organisations’ ability to attract business opportunities and retain clients. Nearly 40% said it could affect their organisation’s reputation and the sustainability of their operations in the long run.

The report also pointed out that the involvement of boards and executive directors in ESG matters is effective in encouraging companies to move towards sustainability. The green bond market and unified carbon emissions trading market in the Guangdong-Hong Kong-Macao Greater Bay Area provides significant opportunities for the development of ESG investing in Hong Kong. However, respondents said they see the lack of a homogenous framework or standardised guidelines for measuring ESG factors as a challenge to implementing ESG practices and measures, corresponding with the result of the AFF online poll.

Heavyweight speakers share views on a range of topics

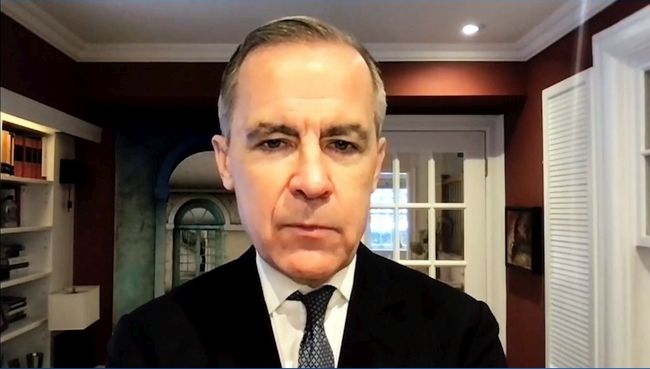

Several keynote speeches were featured at AFF 2022, including an address by Mark Carney, United Nations Special Envoy on Climate Action and Finance. Mr Carney shared his insights on how to build a sustainable financial system as a way of mitigating the liability and transitional threats posed by climate change. He said that governments need to step up with “ambitious, credible and predictable” policies that match their pledges. “Very importantly, countries are encouraged to enact ‘deep decarbonisation’ policies such as the phase-out of internal combustion engine vehicles by 2030 and legislate carbon pricing to deliver certainty. This is about giving greater certainty to investors and businesses, so they can pull forward with investment, smooth adjustments and drive jobs and growth upwards while they force emissions downwards. Finance is stepping up, the system is being changed, and there are enormous opportunities now for countries and companies, from affordable green power to zero-emission steel to low-carbon hydrogen and beyond. The financial sector has moved from being a mirror that reflects a world that hasn’t been doing nearly enough to becoming a window through which ambitious climate action can deliver a sustainable future.”

Another distinguished keynote speaker was Jean-Claude Trichet, Former President of the European Central Bank. He noted that the financial industry, regulators and policymakers should step up their concerted efforts when it comes to addressing key issues related to monetary stability in times of uncertainty. “[Macroprudential regulations] are more important than ever. We have to be very careful with regard to these buffers, countercyclical buffers, the systemic risk buffers, et cetera. We have to be very attentive to the loan-to-deposit ratio, to all these kinds of macroprudentials that are of extraordinary importance. It’s clear that the advanced economies have to be particularly cautious today and particularly attentive to their risks. Because if all that turns out to be a hard landing, every country in the world will pay a very high price for that. And, as always, the least developed, the poorest, the developing economies – they will have the most difficulty,” said Mr Trichet.

Looking at the financial world from a different angle, Michael Milken, Chairman, Milken Institute, shared on the positive changes that his philanthropic work has created for communities, “There is no substitute for continued investments in education. One of the things we learnt from COVID is that we need to provide knowledge and education, as it relates to the environment, to nutrition, and to the promise of science. Just developing new technologies and new techniques that are effective, COVID has shown us it’s not enough. We have to make sure that it is communicated so the billions of people on the planet can fully understand and have access to these technologies.”

Tian Guoli, Chairman, Executive Director, China Construction Bank, said: “In 2022, Asia will likely become a force to boost the development of sustainable development in a world full of uncertainties. Hong Kong will certainly play a more crucial role as an international financial centre.”

Ju Weimin, Vice Chairman, President & CIO, China Investment Corporation, a sovereign wealth fund, offered his analysis of the current macro investment trends in Asia and China, noting that sovereign wealth funds are a key source of global investment capital. “They have been the key players in developing the global financial market; they have grown rapidly and are making a bigger impact on the international market and capital flow. Especially since the global financial crisis, the total size of the sovereign wealth funds worldwide has doubled and is approaching the global size of alternative investment,” Mr Ju said.

Addressing the outlook for cryptocurrencies and blockchain, Sam Bankman-Fried, Founder and CEO of cryptocurrency exchange FTX.com, said: “One of the big goals of crypto is to be able to build an ecosystem where there is financial inclusiveness, where anyone can get equitable access to the financial markets. When you look at traditional markets, you just don’t see that ease of access. For some reason in crypto, the exchanges seem to play a very central role, whereas in the rest of the financial ecosystem they played a relevant role but a less central one. That is one big thing that really changes people’s minds on ecosystems as they walk through it.”

Bestselling author and Founder and Executive Chairman of Moven Brett King, also widely known as the “Godfather of Fintech”, offered his perspectives on how the emergence of innovative fintech solutions presents both an opportunity and a challenge to the banking and financial industries. “The first use of central bank digital currencies (CBDCs) en masse will probably be the Beijing Winter Olympics this year, where we see the CBDCs incorporated into the mobile wallet for the games. This is the first major evolution of money that we have seen since we moved from coins to paper banknotes. In a historical perspective, what we see right now with the creation of CBDCs and cryptocurrencies is an incredible point of change for humanity with respect to the design and intelligence of money,” Mr King said.

Over 700 meetings in AFF Deal Flow in three days

In response to high investment demand, this year’s AFF Deal Flow Matchmaking Session, co-organised by the HKTDC and the Hong Kong Venture Capital and Private Equity Association, is extended by a day and held over three days from 10 to 12 January. The AFF Deal Flow has facilitated collaboration between project owners, potential business partners and investors by arranging over 700 one-on-one meetings and connecting capital with investment projects from around the world. Over 720 projects in the AFF Deal Flow Matchmaking Session covered a wide spectrum of sectors, including fintech, healthtech, deep tech, consumer goods, infrastructure and real estate, environment, energy and environmental technology. More than 230 of the projects were ESG-integrated to meet the related needs of investors.

AFF online platform runs to mid-March, showcasing technologies from 130+ exhibitors

Video playback of all the sessions and virtual exhibitions from AFF 2022 will be available through the event’s online platform until 11 March 2022. Participants can enjoy round-the-clock access to 60 keynote speeches and panel discussions as well the exhibitions of more than 130 local and international financial institutions, tech companies, start-ups and investment agencies, showcasing a plethora of advanced financial technologies and unmissable investment opportunities.

Overview of participants’ responses in AFF 2022 polls

1. What is your outlook for the global economy in 2022?

Optimistic 43%

Neutral 33%

Pessimistic 24%

2. In which sector do you see the most opportunities for green investment in Asia?

Green energy 45%

Transportation infrastructure 14%

Water and waste treatment 9%

Reforestation 2%

Real estate and construction 16%

Agriculture and food 14%

3. What is the most significant barrier preventing your company/institution from implementing more ESG-friendly policies?

The difficulty in balancing ESG practices and business goals 22%

Lack of ESG understanding among key personnel 16%

Lack of unified, easily understandable ESG standards 33%

Poor data quality and consistency in terms of ESG performance evaluation 14%

Lack of commitment to ESG practices among senior management 6%

Insufficient government support 9%

Websites

– Asian Financial Forum: https://www.asianfinancialforum.com/aff/en/

– AFF programme: https://www.asianfinancialforum.com/aff/en/programme/programme

– AFF speakers: https://www.asianfinancialforum.com/aff/en/speaker/main

– Photo download: https://bit.ly/3HRXNQo

Media enquiries

Please contact the HKTDC’s Communications & Public Affairs Department:

Janet Chan, Tel: +852 2584 4369, Email: janet.ch.chan@hktdc.org

Clayton Lauw, Tel: +852 2584 4472, Email: clayton.y.lauw@hktdc.org

Agnes Wat, Tel: +852 2584 4554, Email: agnes.ky.wat@hktdc.org

About HKTDC

The Hong Kong Trade Development Council (HKTDC) is a statutory body established in 1966 to promote, assist and develop Hong Kong’s trade. With 50 offices globally, including 13 in Mainland China, the HKTDC promotes Hong Kong as a two-way global investment and business hub. The HKTDC organises international exhibitions, conferences and business missions to create business opportunities for companies, particularly small and medium-sized enterprises (SMEs), in the mainland and international markets. The HKTDC also provides up-to-date market insights and product information via research reports and digital news channels. For more information, please visit: www.hktdc.com/aboutus. Follow us on Twitter @hktdc and LinkedIn