Infina, Vietnam’s leading digital investment platform, has secured seed funding, raising an oversubscribed 7-digit seed round with 1982 Ventures, Saison Capital, Venturra Capital, 500 Startups, Nextrans and prominent angel investors. Infina, on a mission to democratize investments for Vietnam’s population of 97 million, will use the funds to fuel growth and expand its product offerings.

Launched in January 2021, Infina is the latest to join the boom of investment apps across the region. Amid the pandemic, the startup currently serves tens of thousands of users and has seen its assets under management (AUM) rise more than fourfold. Infina’s financial partners include some of the largest fund managers in the country, including Dragon Capital, Mirae Asset Fund Management and Viet Capital Asset Management.

Herston Powers, Managing Partner of 1982 Ventures stated, “Vietnam is the most promising market in Southeast Asia for the next wave of retail investing. Infina is at the forefront of the retail investing revolution in Vietnam and has quickly become the most trusted brand with millennial investors. Their commitment and experience building online communities is the key differentiator that makes Infina special.”

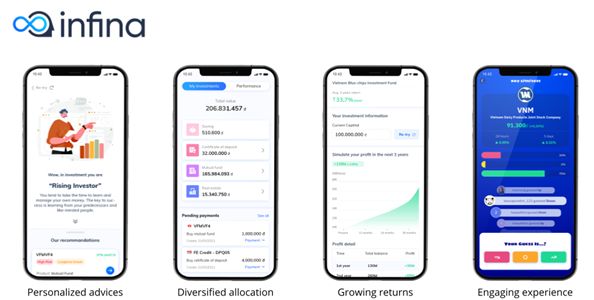

James Vuong, CEO and Co-Founder of Infina stated, “Infina is building the ‘Robinhood of Vietnam’, to make investment accessible, easy, and engaging for the country’s middle and lower classes.” The majority of Vietnamese previously let their money sit in risk-free checking accounts or freeze in long-term real estate. However, millennial investors are shifting toward higher-yield asset categories with smaller required investments.

“As millennial investors shift toward higher-yield asset categories, Infina allows users to make a contribution as low as US$25 into a broad range of assets including savings, term deposits, mutual funds, and fractionalized real estate,” added James. Infina’s customers are primarily millennials aged 25 to 40 who would save or invest their disposable income on family planning, child education and early retirement.

James Vuong is an engineer-turned-VC-turned-startup-founder with a track record in Silicon Valley and Vietnam. In 2008, he returned to Vietnam as VP of Investment and a Kauffman Fellow at IDG Ventures. James launched Infina after exiting the last company he founded which was acquired by the Japanese giant LINE Corporation.

Scott Krivokopich, Managing Partner of 1982 Ventures stated, “Infina is the right team to back to capture this massive opportunity. Vietnam’s digital retail investing industry is at an inflection point driven by rising incomes and millennials.” He added, “Infina is democratizing access to wealth management to a largely underserved market.”

Infina will use the funding to fuel growth and expand product offerings. Infina is built with regional aspirations but will continue to focus on Vietnam due to significant growth opportunities.

About 1982 Ventures

1982 Ventures is the leading seed fund investing in fintech startups in Southeast Asia. Our focus makes us the first port of call for fintech founders and the first money in. Our investments include Southeast Asian Open Banking API Platform Brick, Vietnam’s leading Buy Now, Pay Later Fundiin, Vietnam’s Rent-to-Own Home Financing app Homebase (YC W21), Indonesia’s first Earned Wage Access platform Wagely. 1982 Ventures is investing in and supporting the best founders to positively impact the future of financial services in Southeast Asia. Visit https://1982.vc, or follow us on LinkedIn.

About Infina

Infina is the leading digital investment platform in Vietnam. Infina allows users to invest in higher yield asset categories with smaller required investments – savings, term deposits, mutual funds, and fractionalized real estate. To learn more, visit https://infina.vn/.

Contact:

Herston Powers

1982 Ventures

herston@1982.vc