- S$4.0 million of interest-free loan secured when new directors took over in June 2023

- Foo Kon Tan LLP appointed as the statutory auditor in November 2023

- A second interest-free loan of S$4.0 million was obtained in March 2024

- Completed audit for 18-month financial period from 1 July 2021 to 31 December 2022

- Annual General Meeting for FP2022 scheduled to be held on 10 May 2024

- Preparation for quarterly and full year results announcements as well as audit for financial year ended 31 December 2023 initiated

- Significant progress made to rectify, restore and rejuvenate the Company

- Company is well placed to work towards resumption of trading of the Company’s shares

The board of directors (the Board) of SDAI Limited (the Company” or SDAI, and together with its subsidiaries, the “Group”) today announced that its statutory auditor, Foo Kon Tan LLP (FKT), had in April 2024 completed the Group’s audit for the 18-month financial period from 1 July 2021 to 31 December 2022 (FP2022). The notice of annual general meeting of the Company (AGM) and the Company’s annual report for FP2022 were despatched to shareholders of the Company (Shareholders) on 25 April 2024 and the AGM for FP2022 will be held on 10 May 2024 at the Grand Copthorne Waterfront Hotel. The preparation for quarterly and full- year results announcements as well as the audit work for the 12-month financial year ended 31 December 2023 (FY2023) is currently underway, and the Board will announce the Group’s quarterly and full-year results for FY2023 and hold the next AGM for FY2023 as soon as possible. This is a significant step in working towards the Company’s compliance with reporting requirements for 2024 onwards.

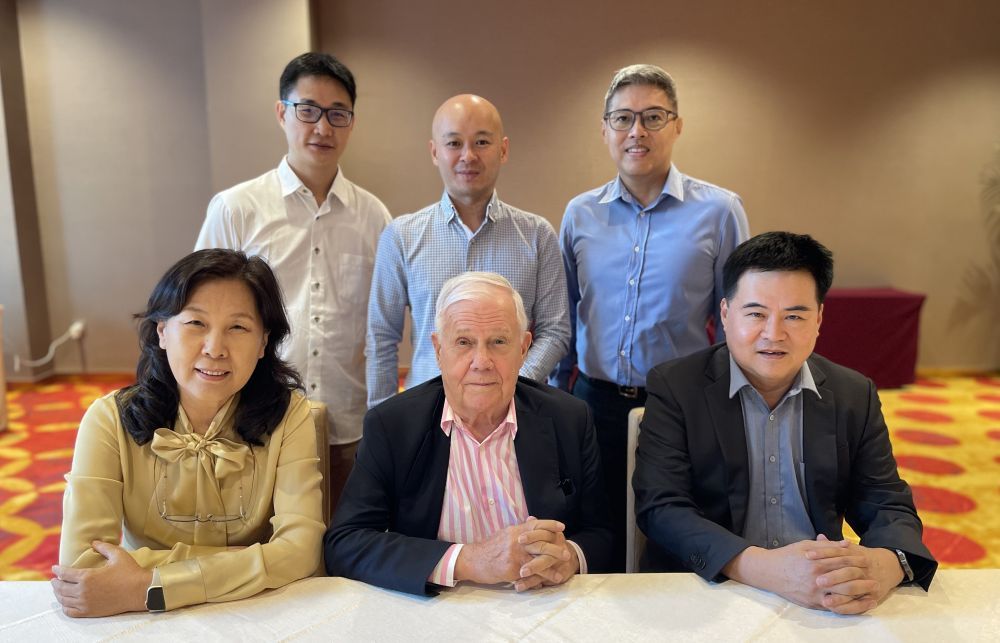

Madam Hao Dongting, Executive Chairperson of the Board, said, “Through the effective stewardship of the new Board, we have now completed the FP2022 audit, a significant step in fulfilling our statutory and reporting responsibilities. While non-compliance issues still need to be rectified, we will continue to work on addressing these to the best of our ability to fulfil all statutory and reporting requirements.”

“I have recently extended an interest-free loan of S$4.0 million to the Company for 18 months starting March 2024 and obtained an extension on the repayment of the first interest-free loan of S$4.0 million, which had originally been due this year, to September 2025. This will address ongoing concerns and ensure adequate working capital for the Group.

We want to reassure Shareholders that the new management and Board are making significant headway in rectifying the missteps and lapses of the past, restoring processes and structures that either did not exist or were broken down and working on rejuvenating the Company by exploring new strategies and businesses to create long-term value. We thank Shareholders for their unwavering and continued trust in our efforts thus far, and the Board is firmly committed to the rebuilding process to right the ship and work towards the resumption of trading and a brighter future for the Company.” added Madam Hao.

Progress since June 2023

Since taking over the reins of the Company on 26 June 2023, the new Board, consisting of qualified and motivated individuals, has left no stone unturned in addressing the multitude of issues that the Company has been beset with over recent years that resulted in numerous non-compliance issues and systemic shortcomings, which finally led to its share suspension in July 2021.

The commitment to rectify and restore in this initial stage repays the trust and confidence of Shareholders placed in the new Board and the firm belief that a new dawn is coming for the Company following severe challenges and shortcomings.

Appointment of Statutory Auditor and FP2022 Audit

SDAI was without a statutory auditor as the last auditor did not seek re-appointment at the AGM held in March 2022 for the financial year ended on 30 June 2021. The Company was thus unable to complete its annual statutory audit for the subsequent periods. The new Board engaged FKT when it assumed office in June 2023 to fulfil the role of a statutory auditor. Due to a multitude of issues arising, amongst others, lapses in financial record keeping, outstanding legal and regulatory issues, non-compliance, risks of economic mismanagement, internal control failure and concerns on the special audits by Deloitte & Touche Financial Advisory Services Pte. Ltd. (“Deloitte”), FKT agreed in late July 2023 to commence the onboarding process.

This onboarding process took 4 months, much longer than anticipated, because of the issues that needed addressing. The Board eventually convened an extraordinary general meeting on 17 November 2023 to obtain Shareholders’ approval to appoint FKT as the statutory auditors of the Company to kick-start the audit for FP2022.

During the recently completed FP2022 audit, FKT uncovered numerous issues at risk and material differences between audited and unaudited financial statements, including, amongst other things, incomplete and inconsistent financial records and other lapses. While the Board and management have sought to address a significant portion of these issues, some of these legacy issues remain substantive. As a result, the auditor has raised various disclaimers on financial statements disclosed in the Independent Auditor’s Report for FP2022, which was announced by the Company on 25 April 2024 under the title, “Disclaimer of Opinion by Independent Auditor on the Audited Financial Statements for the Financial Period Ended 31 December 2022”.

With the issuance of the FP2022 audited financial statements, a line has now been drawn underneath the past, and the Board looks to rejuvenate the Company in the days ahead.

Special Audit Phase 2 by Deloitte

The Company had announced in July 2023 the receipt of the executive summary of the Special Audit Report (Phase 1) detailing issues with certain payroll matters and unauthorised transactions. The closure of Phase 1 is a significant step towards finalising the special audit since the appointment of Deloitte as special auditor in September 2021. The Board is now focused on finalising Phase 2 of the independent special audit with Deloitte, which relates primarily to the deviation of usage of around S$19.3 million previously raised by the Company that were fully disbursed for purposes other than the intended usage for new businesses to turn the Company around.

Loans of S$8.0 million Secured

On 27 March 2024, SDAI announced that it had obtained a second interest-free loan of S$4.0 million from Madam Hao, its Executive Chairperson, for 18 months. For the first S$4.0 million interest-free loan secured in June 2023 from Asian Accounts Receivable Exchange Pte. Ltd., SDAI has obtained an 18-month extension to 26 September 2025. The new loan of S$4.0 million and the extension of the previous S$4.0 million loan will preserve the Company’s going concern status and pave the way for the Company towards a turnaround.

The Future

The Company has also been working assiduously to accelerate the process of completing Phase 2 of the independent special audit conducted by Deloitte in compliance with statutory requirements, which will be another key factor in the resumption of trading of the Company’s shares.

In addition, the Board is working on securing new businesses and collaborations to give the Company a new lease of life. With the above positive developments, the Company is well-placed to work towards trade resumption of the Company’s shares.

About SDAI Limited

SDAI Limited (formerly known as Kitchen Culture Holdings Ltd.) was listed on the Catalist board of the SGX-ST on 22 July 2011. The Company has been suspended from trading since July 2021 after responding to the SGX- ST’s queries.

On 26 June 2023, SDAI announced changes to the Board composition, resulting in the constitution of a new Board. The immediate tasks for the Board are to resolve all the outstanding legacy issues, including settling long overdue liabilities, completing the special audit, and strengthening the internal controls so as to elevate the Company to the position of pursuing new businesses.

The Group’s principal business of distributing high-end kitchen systems, kitchen appliances, wardrobe systems, bathroom furniture, household furniture and kitchen accessories from Europe reduced significantly after its principal wholly-owned subsidiary, KHL Marketing Asia-Pacific Pte. Ltd., entered into a compulsory liquidation on 5 April 2022 from the winding up application filed by Kim Hup Lee & Co. (Private) Limited.

ISSUED BY SDAI LIMITED:

This media release has been prepared by the Company and its contents have been reviewed by the Company’s sponsor, ZICO Capital Pte. Ltd. (the “Sponsor”), in accordance with Rule 226(2)(b) of the Singapore Exchange Securities Trading Limited (the “SGX-ST”) Listing Manual Section B: Rules of Catalist.

This media release has not been examined or approved by the SGX-ST and the SGX-ST assumes no responsibility for the contents of this media release, including the correctness of any of the statements or opinions made or reports contained in this media release.

The contact person for the Sponsor is Ms Goh Mei Xian, Director, ZICO Capital Pte. Ltd. at 77 Robinson Road, #06-03 Robinson 77, Singapore 068896, telephone (65) 6636 4201.

For media queries, please reach out to: Waterbrooks Consultants

Wayne Koo – wayne.koo@waterbrooks.com.sg +65 9338-8166

Derek Yeo – derek@waterbrooks.com.sg +65 9791-4707

Proud Investor Relations partner: https://www.waterbrooks.com.sg/ https://www.alphainvestholdings.com/