Social networking establishes the connection and interaction between people. Entering the Internet era, social networking products bring everyone closer to each other. For Internet companies, social networking products are closest to people and can build an infinite commercialization derivative space based on the relationship chain, which is why this business looks both sexy and real.

Recently, ShineGlobal, a global industry think tank, released the “Global Audio and Video Social Networking Market Report 2022” which provides a detailed overview of the global audio and video social networking market size, market segmentation in 2022, and the industry development trends in 2023.

After the epidemic, audio and video social networking has undoubtedly become the most popular product format in the sector, and more and more developers are eager to have a try. In addition to TikTok, a short-video app that has successfully achieved globalization in recent years, audio and video social apps such as Match Group’s Azar, Joyy’s Bigo Live, and NewbornTown’s MICO have gradually become the main force of globalization.

1. Audio and Video Social Networking Has Become the “Rigid Demand” for Users Around the World

In 2022, although our offline activities gradually restored, the online life is still a major trend, and people continue to migrate their life scenes from offline to online. Social networking, as an indispensable part of people’s daily life, has maintained a rapid growth. Currently, most social networking products on the market have incorporated audio or video features with strong immersion, making users, especially the young, more dependent on these products.

According to Frost & Sullivan’s forecast, the global social media market size is expected to grow at a CAGR of 15.1% from 2021 to 2024, with a CAGR of 27.6% for video social market size and 25.8% for audio social market size. The growth rate of audio and video social far exceeds the overall growth rate of online social market. It is expected that by 2024, the overall size of the global social media market will reach US$300 billion, of which the audio and video social market size is US$181.3 billion. Video social is expected to reach US$128.7 billion, accounting for 42.8%; audio social is expected to reach US$52.6 billion, accounting for 17.5%.

Currently, the normalization of the epidemic has driven a high increase in users’ time spent on social media in almost every country and region. In social apps, there is an average of 325% year-over-year growth in usage time per user. This trend is also reflected in the number of downloads. According to Branch, downloads of social apps saw rapid growth at the beginning of the outbreak, and maintained a stable trend afterwards.

In terms of market performance, global audio and video social app downloads are mainly from countries such as India, the US, Brazil, and Indonesia, while users from countries in the Middle East, Africa, and other emerging markets are embracing audio and video social products most rapidly.

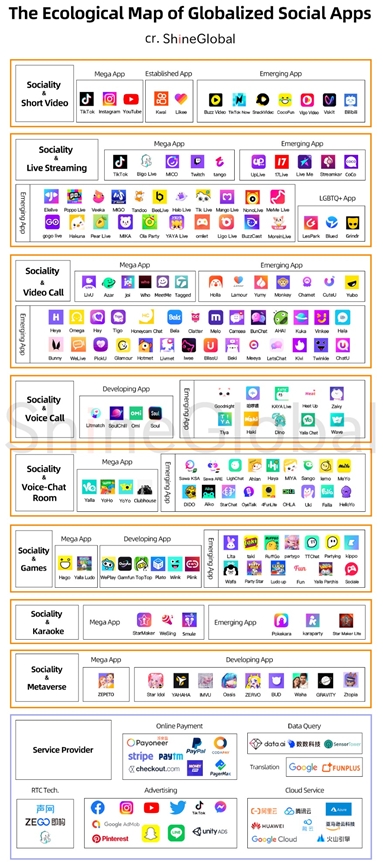

In addition, the Report lists in detail the mega apps and established apps in each segment of the audio and video social networking, as well as products that have achieved rapid growth since 2022. For example, in “Sociality + Live streaming”, Bigo Live and MICO are at the top. In “Sociality + Voice Call”, Litmatch has grown rapidly in the past year, and its cumulative downloads exceeded 45 million in the first 10 months of 2022. In “Sociality + Game”, WePlay is recognized as the product that has rapidly captured the hearts of young users in many markets around the world in the past year.

2. ByteDance, Match Group, NewbornTown and Joyy Group Have Stepped Out of Various Successful Routes

It’s easy to get a social app to gain the favor of a group of people, but it’s tough to get it popular in multiple countries around the world and become an integral part of their social entertainment lives. Gaining a firm foothold in multiple regions and developing into a global social product cannot be achieved without innovative product ideas and mature operation methods. ByteDance, Match Group, NewbornTown, and Joyy Group have been able to stand out from the fierce competition by putting on unique “armor” for their products.

ByteDance: Copying + Localization

We can say, the most successful global social product in recent years is TikTok. In the harsh international environment, its global monthly active users exceed 1.5 billion, making it not only the fifth largest social app in the world, but also overturn the landscape of online video social networking. In the US and UK, the average monthly usage time of the app has exceeded that of YouTube, affecting the entire mobile ecological landscape and stimulating the rise of a number of short-video platforms, such as India’s MX TakaTak and Moj, both of which were ranked in the top 10 apps with breakthrough in downloads by data.ai. Today, ByteDance has made TikTok a threat to YouTube, Snapchat and Instagram.

TikTok has leveraged some of the strategies that have proven successful in China. Previously, Douyin, the Chinese version of TikTok, gained traction by using “hashtag challenges,” such as its partnership with Haidilao Hot Pot to call on users to create their own hot pot recipes. Such regular region-specific events proved to be a sustainable strategy for user growth. In the US, TikTok partnered with famous American host Jimmy Fallon’s hit show to launch the “#TumbleweedChallenge”, which brought TikTok great exposure.

In terms of market selection, the first phase of TikTok’s globalization layout chose to be in Japan, South Korea and Southeast Asia. Zhang Yiming, the founder of ByteDance, believes that Japan is a market where overseas products are not accepted easily, so Japan can be a litmus test for globalization to some extent. If Japanese users can accept a product, then users in Southeast Asia and other Asian countries can also accept it.

In August 2017, TikTok landed in Japan and set up its first overseas office there. In just three months, TikTok reached the first place in the list of free apps in App Store in Japan, and then topped the same list in Thailand in January 2018. Subsequently, TikTok could be found in the top 10 most-downloaded apps in many Southeast Asian countries. Then, TikTok directly began to expand into the North American market, and gradually expanded from North America to other markets.

TikTok’s success is also based on its understanding of local users. ByteDance has adopted a polycentric-oriented strategy when expanding to different markets at the same time. The reason is obvious: The algorithm-driven product model is applicable and standard, but video content is not, so ByteDance set up subsidiaries in different countries to make TikTok better localized and launched different versions of TikTok to users.

NewbornTown: Brand Marketing Based on Local Conditions

NewbornTown also made localized development as its competitive advantage. It has been on the road to globalization since 2013 and has built a mature and replicable system for globalized operations, enabling its products to land quickly in key markets and grow efficiently with localization. In the past year, the company has further rooted itself in regional markets and continued to deepen its localized operations.

To expand its brand presence in different countries and regions, and to make users not feel that they are using a foreign product, MICO, NewbornTown’s live-streaming social app, is conducting brand marketing campaigns in different markets to suit local cultures and customs.

In the US, MICO provided a platform for local rap fans to show themselves, shooting music videos for contest winners; in Japan, MICO held joint events with local soccer clubs; in Thailand and Vietnam, MICO joined hands with famous local musicians to create theme songs and shoot music videos, which have created a wave of discussion in local social media; in the Middle East, MICO held industry media gatherings and creators’ conferences, to promote a positive perception of the online social entertainment industry in the local community, and promote the development of the industry in the Middle East.

Today, MICO is the head live-streaming social product in the Middle East and Southeast Asia, and is rapidly expanding in North America, Japan and South Korea. Through a mature and replicable globalized operation system, NewbornTown’s customer acquisition efficiency and operation efficiency have been continuously improved, and it has surged in the global social market.

Match Group: Acquisition After Acquisition

Match Group, a global dating giant, is the parent company of Tinder. After launching Tinder in 2012, Match Group has acquired a number of dating apps such as Meetic, Plenty of Fish and Hinge. In 2021, Match Group acquired Hyperconnect, a Korean social media company, for US$1.73 billion, which was Match Group’s largest acquisition to date.

Hyperconnect’s core product is Azar, which has grown to become the highest-grossing one-on-one video social app in the world. According to Match Group’s CEO Shar Duby, 75% of Hyperconnect’s revenue and users come from Asia, just to complete Match Group’s regional strategic footprint.

In addition to complementing the markets, Match Group is also looking at its “live video” technology. Previously, Match Group’s apps were still based on profile matching and swipe-matching, and this acquisition may be more of a complement of product type.

It can be said that Match Group is a dating company that grew up by self-operation and acquisition at the same time. Through self-development + acquisition along the way, Match Group is now a huge dating empire with dozens of dating products such as Tinder, Match, Hinge, Meetic, OkCupid, Pairs, Plenty Of Fish, OurTime, Azar, The League, and others.

Joyy Group: Cost Reducing and Efficiency Enhancement, Back to the Essence of Business

In the midst of the overall global economic downturn and the decline in users and revenue of online products, the audio and video social industry continues to grow. However, in 2022, the user growth rate of many audio and video social products declined, and one of the reasons for this phenomenon is that many companies cut costs and increased efficiency, greatly reducing their investment in marketing.

In this regard, several practitioners expressed the same view. Most of them believe that in 2022 many social companies reduced costs and increased efficiency, returning to the essence of business. The person in charge of an audio technology service provider said that since the last year, with the increasing cost of customer acquisition, many products have shifted from the pursuit of user growth to the pursuit of revenue generated by users, focusing more on cash flow.

Take BIGO, the global business of Joyy Group, as an example, in the second quarter of 2021, BIGO’s revenue reached US$598 million, with total costs + expenses of US$570 million and adjusted net profit of US$19.44 million, an adjusted net margin of 3.3%. In the second quarter of 2022, BIGO’s revenue reached US$503 million, with total costs + expenses of US$445 million. However, its adjusted net profit reached US$86.3 million, with an adjusted net margin of 17.2%. It is widely believed that cost reduction and efficiency enhancement is one of the reasons for the steady growth of BIGO’s earnings.

To conclude, many social industry practitioners believe that the product format of “Sociality + X” and products focusing on a certain vertical group will have more opportunities for development, and it will be difficult to see the competitive pattern of one single player getting dominance.

We still believe that there will be a lot of globalized social products in the future, and we are all looking forward to the birth of the next “TikTok”.

For further information, please contact:

PEANUT MEDIA LIMITED

Direct Line: +86-755-61619798 x8210

Email: hswh.project@czgmcn.com